Hurricanes Aid Push for Refineries

Katrina and Rita laid bare how limited U.S. fuel-making capacity has become, triggering new efforts to get plants up and running.

Source of this article – Los Angeles Times, October 3, 2005, 2005.

By Elizabeth Douglass

Times Staff Writer

Billionaire Richard Branson says he wants one. So do Kuwaiti oil sheiks. And a small but determined band of investors dream of planting one in the Arizona desert.

High gasoline prices, hurricane-triggered shortages and big refining profits are fueling a push to build the nation’s first new oil refinery in 30 years.

The same forces are also triggering renewed efforts in Congress to give incentives and regulatory breaks to companies that expand their plants to produce more gasoline and diesel and jet fuel.

What’s driving these efforts is that fuel production from U.S. refineries has not kept pace with the demand from a rebounding economy. The result has been painful price surges for consumers, truckers and airlines.

It’s a problem that’s been building for 25 years, starting in the early 1980s, when overproduction and heavy losses forced smaller operators out of business. The trend accelerated in the 1990s, as federal and state regulators began mandating cleaner fuels and costly environmental upgrades. Then a wave of mega-mergers among oil companies led to more closures, as those firms saw consolidation as the shortest path to profits.

When hurricanes Katrina and Rita hit the Gulf Coast, they laid bare just how fragile the U.S. refining system had become. The storms knocked out fuel production and vital pipelines along the coast from Alabama to Texas and sent pump prices to record highs.

“It is unfortunate that it takes a hurricane to show us just how acute that problem is,” said Rep. Joe L. Barton (R-Texas), chairman of the House Energy and Commerce Committee, whose proposed Gasoline for America’s Security Act of 2005 passed through the committee last week without any hearings on its sweeping provisions.

Among other things, Barton’s gasoline act would limit government review of plant modifications, put the federal government in charge of shepherding refinery projects on strict timelines, and establish a “standby refinery support account” allowing the government to compensate applicants for certain kinds of delays in refinery construction and refurbishment projects.

In June, long before that and other measures were proposed in Congress, British tycoon Branson declared his interest in building a refinery to blunt the effects of soaring jet fuel prices on Virgin Atlantic Airways, his flagship airline. The entrepreneur, whose holdings also include mobile phones, soft drinks and insurance, said recently that he was considering Europe and Africa — and sounding out officials in parts of the United States — for the refinery project.

Last month Kuwaiti officials renewed an earlier offer to build a U.S. refinery. They sketched out a proposal for state-owed Kuwait Petroleum Corp. to form a joint venture for the project, and the country’s oil minister hinted that a preliminary agreement could be reached as soon as this month.

It was unclear whether the discussions would be invigorated by new congressional action.

“We’re waiting to see where they go,” said Bob Slaughter, president of the National Petrochemical and Refiners Assn., a trade group. “Whenever people say they want to build a refinery, we say, ‘Please go ahead.’ ”

Despite the growing refinery buzz and legislative proposals, motorists shouldn’t bet their gas budgets on the prospect of timely relief, oil experts say.

For starters, it would take five years or more to design and build a refinery and at least two years to complete a meaningful expansion at an existing plant. In addition, the mere mention of a refinery project would provoke fierce opposition from neighboring communities, making it difficult if not impossible to secure the necessary permits.

Arizona Clean Fuels is a case in point. The Phoenix company has spent 12 years looking for funds and nurturing a vision of building this country’s first refinery since 1976. This year the proposed plant, to be built near Yuma, Ariz., cleared what’s considered the single biggest environmental hurdle for such projects: It got an air permit.

Glenn McGinnis, chief executive of Arizona Clean Fuels, says recent events have spurred serious talks with potential investors that could soon yield the $75 million he needs to fund engineering work. A tax break in the recently enacted energy bill speeds up returns for his possible investors, and the actions being considered by Congress would improve the outlook even more, McGinnis said.

But many more approvals and permits still must be secured over the objections of community activists. And there’s the matter of the $2.5-billion price tag.

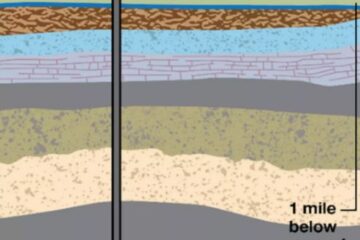

Today, 148 U.S. refineries are in business, down from a peak of 324 in 1981. During the last five years, the remaining plants have expanded their ability to turn oil into petroleum products by nearly 700,000 barrels a day and now often operate near their processing capacity of about 17 million barrels of crude oil a day. That’s about 4 million barrels short of the nation’s daily consumption.

Imports have grown steadily to pick up the slack, and for a time they masked the growing gap between domestic fuel supply and demand.

The problems became apparent first in California, where the state’s lack of spare gasoline-making capacity has for years led to price hikes — and extra profits for oil companies — whenever there was the slightest production glitch.

Barton said his bill would boost lagging gasoline supplies and lower prices for consumers. A host of other legislation, including a Senate bill similar to Barton’s, also takes aim at the issue.

Slaughter, the trade group official, applauded the stepped-up attention being paid to the refining shortfall.

“If we think we need more refining in the United States, it’s a good idea to eliminate disincentives at a time when people are at least starting to think more favorably about investing in refining,” he said.

Tim Hamilton, an oil company critic who once owned gas stations, took the opposite view. “It defies common sense to go into an industry whose profits are huge because of the closing of refineries and try to bribe them into enlarging capacity,” he said.

Barton’s bill also faces adversaries such as Clean Air Watch, an environmental group that called the lawmaker’s bill “the biggest weakening of the Clean Air Act in history.” The National League of Cities, another critic, complained that the bill would preempt local authorities.

The most daunting obstacle, however, might be the oil companies themselves. After all, they are profiting mightily from the status quo.

Some companies, such as Valero Energy Corp., the nation’s largest refining company, have charged ahead anyway, buying up refineries and boosting capacity in the belief that fuel demand and profit will be strong for the foreseeable future.

A few refiners have joined in with expansion plans of their own, but Exxon Mobil Corp. and others have hung back, convinced that a reversal of fortune lurks in the future, according to D.J. Peterson, lead author of a 2003 Rand Corp. study on refining.

Oil companies have taken note that the high fuel prices have begun to reduce demand, and they are mindful that a recession, the rise in hybrid cars and aggressive conservation could sharply reduce consumption in the next decade, Peterson said. Thus, even with government incentives, he said, “it’s not clear that refiners would be stepping to the plate.”

Fadel Gheit, an oil analyst at investment company Oppenheimer & Co., had a similar view.

Refiners “cannot take a chance on overexpanding, because it will just accelerate what they fear most, which is a total collapse in refining margins,” he said.

“In the last two years they look like they have been printing money, and they don’t want the party to end anytime soon.”