Offshore Leaseholders Win $1.1 Billion

The U.S. is ordered to reimburse fees paid by oil and gas firms for tracts off the California coast where drilling has long been delayed.

Source of this article – Los Angeles Times, November 18, 2005

By KENNETH R. Weiss, Times Staff Writer

A federal judge has ordered the U.S. government to repay $1.1 billion to oil and gas companies that have long held dozens of leases off the California coast i but faced repeated delays in developing them into working undersea oil fields.

The decision, released Thursday by the U.S. Court of Federal Claims in Washington, D.C., represents a significant step toward resolving the fate of the 36. undeveloped tracts off Ventura, Santa Barbara and San Luis Obispo counties.

The 13 oil and gas companies that won Thursday’s ruling are prepared to give back these leases as soon as they get the $1.1 billion and a few hundred million in related costs, said their lead attorney, Edward Bruce.

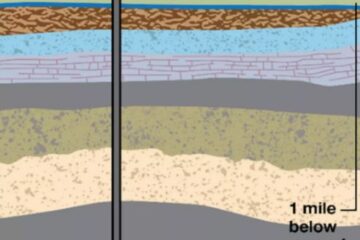

The leases sit atop an estimated 512 million barrels of oil, but have never been developed, in part as a result of delays by federal regulators, the state’s environmental safety concerns, various lawsuits and congressional efforts to give states more power to assess the effects of oil drilling.

Judge Eric G. Bruggtnk, in a 42-page opinion, ruled that the congressional act in 1990, which gave states clearer authority to review oil drilling in federal waters off their shores, breached a contract with oil companies by changing the rules.

That, Bruggink ruled, entitled the companies to be reimbursed for what they paid decades ago for the 36 leases.

Bruce said the oil companies would continue to press for an additional $145 million for four other leases that were canceled by the federal government and for hundreds of millions of dollars spent over the years on exploratory drilling and other costs.

Patricia McCarthy, a Justice Department lawyer handling the case, could not be reached Thursday. A Justice Department spokesman declined to comment.

“It seems to me that this is another giveaway to the oil companies,” said Peter Douglas, executive director of the California Coastal Commission.

He said Congress in 1990 amended the law to make it clear that states had a right to review offshore drilling, not reject it.

If the Interior Department’s Minerals Management Service had done its job of providing sufficient information, he said, the Coastal Commission probably would have given its blessing to the offshore leases and the federal judge probably would never have had to rule on them.

“Maybe they wanted the oil companies to win,” Douglas said.

In a related case in August, U.S. District Judge Claudia Wilken in Oakland blocked any exploratory wells or other activity in the 36 tracts until the Minerals Management Service performs a more extensive environmental analysis of potential harm.

She has faulted the agency for failing to meet the standards of environmental protection laws.

The Interior Department has appealed her decision.

Both cases have focused on the same 36 tracts, which were leased between 1968 and 1982 but never developed. They are clustered in federal waters off the coast from Oxnard to San Luis Obispo. Federal waters begin three miles offshore.

The tracts are near 43 others that have been in production for many years, their presence identifiable by offshore platforms.

California’s interest in new offshore drilling soured after a 1969 oil platform blowout off Santa Barbara coated the beaches with black ooze and killed thousands of birds and marine mammals. That made it more difficult for oil companies to move into production, as did a long period of depressed oil prices, which ended a few years ago.

Congress has placed the rest of California’s coast off-limits to new oil leasing or drilling since 1981. The same is true for much of the rest of the nation’s coastlines.

This year, House Resources Committee Chairman Richard W. Pombo (R-Tracy) and other pro-drilling Republicans have been trying to unravel the moratorium with a proposal to give states the option to seek offshore drilling for a bigger share of oil revenue or apply to the federal government for continued protections.

If successful, those efforts could open California to new oil and gas leasing anywhere on the coast.

The companies that won the $l.l-billion judgment are Amber Resources Co., Aera Energy, Anadarko E&P Co., Delta Petroleum Corp., Devon Energy Production Co., Plains Exploration and Production Co., Ogle Petroleum, OLAC Resources, Nycal Offshore Development Corp., Poseidon Petroleum, RME Petroleum Co., Nobel Energy and Total E&P USA.

Aera Energy, which has the largest share of the leases, is co-owned by Shell and Exxon Mobil Corp